One of the pillars of American economy “The Housing Market” is showing the signs of resurgence. The year 2012 was a promising one for housing. With consistent improvements in housing construction and prices, home building is starting again to contribute to the economy.

But before delve deeper into the housing industry let’s paint a picture of the economy.

Jobs

The jobs market continued to recover slowly but surely.

Talk about steady: The U.S. created, on average, 153,000 non-farm jobs each month over the course of 2012; the U.S. also averaged 153,000 non-farm jobs a month during 2011. The unemployment rate has slowly improved, falling to 7.8% at the end of the year, but the labor market remains far from booming.

GDP

GDP in lay mans terms tells you how fast the economy grew. At a high level GDP primarily comprises of the Consumer Spending, Export vs Import and Inventory. Looking at the above chart it’s easy to conclude that growth has been at best sluggish.

In all, the anemic recovery has done little to bolster the housing market but has been enough to pull it out of the troughs.

Housing Industry

“The housing market is coming back, gaining momentum, and it’s one of the bright spots for the economy as we start 2013,” said Robert Dye, chief economist at Comerica Inc. in Dallas.

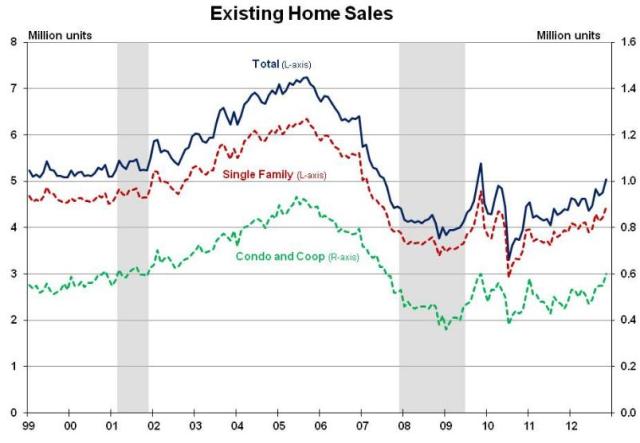

Existing and New Home Sales on the Rise

Sales of U.S. homes probably rose in December to the highest level in three years. Combined purchases of new and existing properties climbed to a 5.49 million annual rate last month, the highest level since November 2009. Purchases of previously owned home climbed to a 5.1 million annual rate in December, the strongest since November 2009, economists project National Association of Realtors figures will show Tuesday. New-home sales picked up to a 385,000 annual rate for the month, the best showing since April 2010.

Builder Sentiment is Running High

Nonetheless, the economic improvements witnessed in 2012 – at least compared to the terrible years that preceded it – manifested themselves in ongoing good news for housing. The December increase in starts is consistent with the upward path of builder confidence over the last few months, as measured by the NAHB/Wells Fargo Housing Market Index (HMI). You can see below that there has been a surge in builder confidence specially since the later half of 2011.

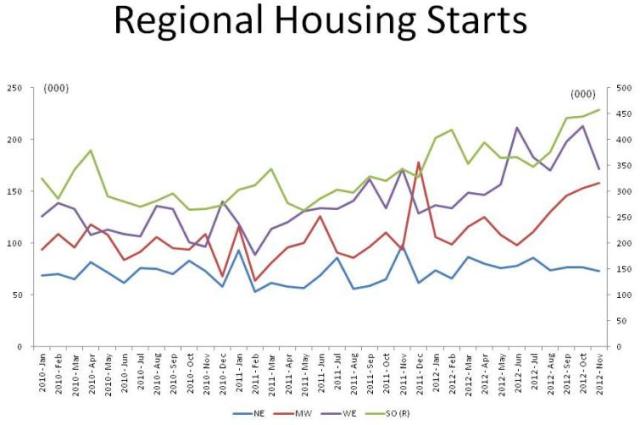

Construction Spending Gets a Boost

Per Census data, solid gains in both single-family and multifamily production resulted in nationwide housing starts rising 12.1% to a seasonally adjusted annual rate of 954,000 units: the highest level of new home production since June 2008. Single-family starts rose 8.1% to a seasonally adjusted annual rate of 616,000 units in December, while multifamily production jumped 23.1%, to 338,000 units. The improvement in home building in 2012 has boosted construction spending. Following graph corroborates this fact.

Dwindling Inventory

As a result of the pickup in demand, the inventory of homes for sale has dwindled, driving up real-estate values and encouraging more construction. There were 2.03 million existing homes on the market in November, the fewest since December 2001, and 151,000 new houses for sale, close to the 142,000 reached in July that was the lowest since records began in 1963.

Here’s TD Securities with some commentary:

The new homes market has been a laggard in the overall housing market recovery, and while new home building and existing home sales activity have risen significantly from their lows, new home sales have yet to enjoy a similar turnaround in fortune. In December, we expect sales activity to improve only modestly, with the pace of sales boasting a respectable 6.1% m/m gain to 400K. The increase in sales will add to the positive momentum in November, when sales rose an equally impressive 4.4% m/m, justifying the surge in optimism among home builders (as seen in the NAHB home builders’ sentiment report) about sales prospects in recent months. In the coming months, we expect the positive momentum in new home sales activity to be sustained, though it is likely to continue to lag the buoyancy in the existing homes market.

Here’s TD’s chart. Hopefully, the increasing home buyer traffic will eventually lead to a pick up in sales.