After celebrating the turnaround in the housing, let’s look at some of the housing stocks. The inventories are at the rock bottom and there is pent up demand in the market. We will get deeper insight when 6 Home builders report their quarterly earnings in the coming week. So should we dip our toes in to profit or pull our money out?

Not really my dear friends. Overall, home-builders have dramatically outperformed the stock market in the last year. Pulte Group (PHM) shares have nearly tripled in price; And Ryland (RYL), Standard Pacific (SPF) and MDC Holdings (MDC) have doubled in value. As a matter of fact shares of Lennar (LEN) rose 97% and DR Horton (DHI) increased by 57%. But one thing to remember is – PulteGroup fell 69% in 2007, Lennar lost 66% in 2007 and then 52% in 2008, and DR Horton stock declined 50% in 2007 and 46% in 2008.

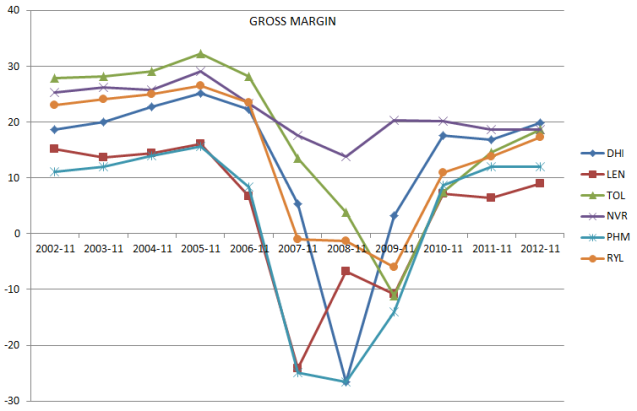

As Lombard Street Research analyst Melissa Kidd notes, home-builders’ profits have actually risen faster than their prices, and their net profit margins are higher than pre-crash peak levels. Let’s look at the gross margin.

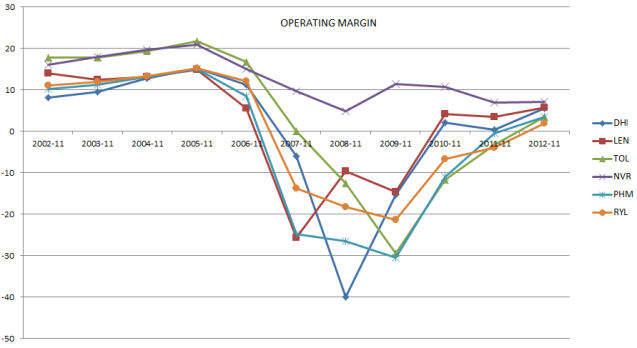

As you can see that the gross margin of the giant Pulte and the whole sale builder DR Horton are at their pre-crash levels. But the operating margins are not there yet.

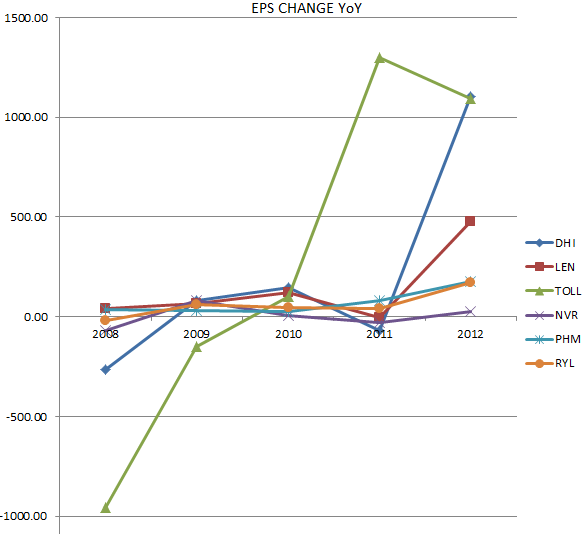

All these recovery in the margins and the earnings are sans the fact that home prices are up by just 7% Year-Over-Year. Most of the analysts might concur that the recent stock price rise have all the earnings rise (see below) and the future profits baked in.

Let’s analyze some companies whose stock prices have sky rocketed in last few months.

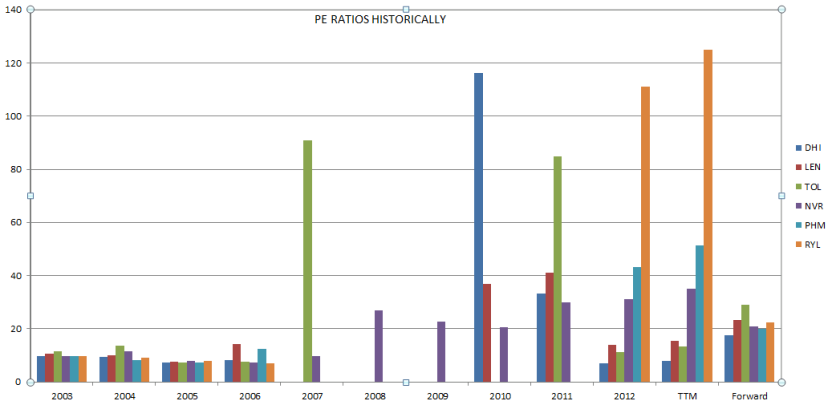

Even after PulteGroup’s run-up, its price-to-forward-earnings ratio is 17.7, according to FactSet; revenue for 2012 is estimated at $4.7 billion, while this year it’s expected to climb to $6.1 billion.Meanwhile, Lennar’s stock is trading at 23.3 times forward earnings, with its financial year 2012 revenue of $4.1 billion estimated to grow to $5.4 billion. It’s a similar story for DR Horton, which has a price-to-forward-earnings ratio of 21, and is expected to see its $4.4 billion FY2012 revenue grow more than 25% to about $5.6 billion. Let’s look at the historical PE comparison.

Juxtaposing all the premium home-builders in US, it is easy to conclude that the mean P/E multiple was around 10 before the boom and the bust. But now the scenario is different. Even though we are far off from the peak of new home sales of 1.3 million in 2005, the new home sales are growing at brisk pace in last 5 quarters. Expectations for housing starts and new home sales are both in the 20 percent range for 2013. So a forward P/E of 23 for a growth in excess of 25% is acceptable.

Recently Lennar announced its earnings. The Florida-based builder crushed estimates as fourth-quarter earnings more than tripled on 42% higher sales. Lennar’s new orders rose 20% and its order backlog was up 35% as of November. Lennar CEO Stuart Miller said in the company’s earnings announcement that the housing market is stabilizing, “driven by a combination of low home prices and low interest rates, making the decision to purchase a new home more attractive.”

Similar expectations are for DR Horton and Ryland homes. The 24 analysts polled by Thomson Reuters expect Horton to report fiscal first-quarter earnings per share of 14 cents, a 56% rise from last year’s 9 cents. Sales are seen advancing 21% to $1.1 billion. Ryland is forecast to report a huge jump in Q4 EPS to 49 cents, up from 2 cents a year ago. Revenue is projected to grow 55% to $404.4 million.

“Just because the stocks are overvalued doesn’t mean they are not going to go up more,” says David Goldberg, a housing analyst at UBS. “It’s a momentum play.” Goldberg warns, however, that there is a lot of growth baked into these stock valuations for 2013, expectations that may be tough to meet. This uptick might not be at 45 Degree angle and might have pauses but the time is not to cash out of them.

Let’s hold onto them and add some more during pullbacks. So which are the companies that are worth adding to the portfolio. Based on the operating margins, earnings growth and PE ratios (historical, TTM and Forward) I believe Lennar and DR Horton are the best of the pack. I would also like to mention TOL. But please don’t buy anything now. Be patient and wait for pull back to 50 DMA. Why DHI and LEN? We will talk about it in the next post.

Lastly, if you don’t feel comfortable buying these home builders, you can own the Home Builders ETF (ITB). Another way to play housing recovery is by buying companies such as Home Depot (HD) (re-modeling, new home set up etc.), Sherwin-Williams (SHW) (Paints), Tronox Inc (TROX) (Pigment for paints) and Corelogix (CLGX) (Mortgage related information provider).